Alford Hughes, Qatar’s only international prime real estate office, recently held an exclusive open day event in partnership with the Spanish Chamber of Commerce aimed at highlighting the wealth of opportunities within the Spanish property market. The event brought together investors, industry experts, and key stakeholders to explore why Spain continues to be a prime destination for real estate investment. From the luxury seaside villas in Marbella and the cosmopolitan charm of Madrid, to the cultural vibrancy of Barcelona, Spain’s key regions offer both high returns and strong rental yields, making them lucrative options for those looking to diversify their portfolios.

Spain’s real estate market stands out for several compelling reasons, which were key discussion points during Alford Hughes’ open day event included:

- Tourism-Driven Demand

Spain’s thriving tourism industry plays a significant role in sustaining property demand across popular regions. Barcelona, Madrid, and the Costa del Sol see a consistent flow of international visitors, bolstering the demand for rental properties and creating lucrative investment opportunities. - Stable Economic Growth

Despite global economic shifts, Spain has maintained economic stability, making it a secure environment for property investors. This stability has encouraged both long-term investments and short-term rental ventures, ensuring strong market performance across Spain’s regions. - High Rental Yields and Property Value Appreciation

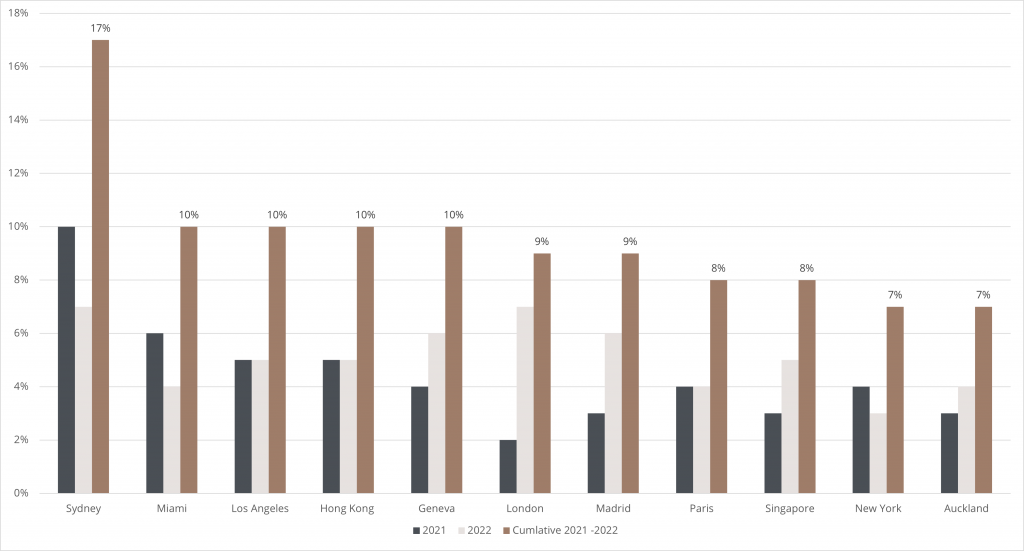

The Spanish property market is known for its relatively high rental yields, especially in high-demand areas like Marbella and Madrid. Alford Hughes’ experts highlighted how strategic investments in these regions can yield significant returns while capitalizing on property appreciation over time.

During the event, Alford Hughes showcased their comprehensive, end-to-end services designed to guide investors through every stage of the international property acquisition process. The company offers tailored advisory services to help clients identify high-potential investment opportunities, manage legal and financial aspects, and navigate the complexities of international property transactions. Alford Hughes also highlighted its innovative remote property management solutions, including a proprietary property management app that provides a complete portfolio overview, rental management and regular maintenance updates, ensuring clients’ properties are well-maintained and continuously generating value.

Mohammed Al Baker, Founder, Alford Hughes, expressed, “This event is a testimony to Alford Hughes’ commitment to bring the most exclusive international real estate investment opportunities to investors from Qatar. We’d like to thank the Spanish Chamber of Commerce, for their support in helping organize this event. We look forward to bringing more such events to benefit the growing community of international real estate investors in Qatar”.