Alford Hughes, Qatar’s only international prime real estate office, hosted an exclusive Qatar showcase of River Park Tower, a landmark residential tower located in Nine Elms, one of London’s most central and connected districts in Zone 1.

Held on 7th July at Alford Hughes Lounge at the Pearl Island, the event welcomed a select group of investors and private clients to explore ownership opportunities in River Park Tower. Attendees were introduced to the project’s design and prime location benefits through one-on-one sessions with the Alford Hughes advisory team.

Part of the One Nine Elms development, River Park Tower offers iconic views of the River Thames, five-star Park Hyatt service, and prime Zone 1 location with direct access to Nine Elms Park. With premium full-service apartments with high-end finishing, featuring world-class luxurious amenities including a Sky Garden, private cinema, wellness center, residents’ lounge, and 24-hour concierge, residents benefit from a luxury living experience like no other.

Designed by KPF Architects, renowned globally for their iconic designs including Singapore’s Changi Airport Terminal 5, River Park Tower offers residents with an opportunity to be part of a landmark address in Central London.

The property’s location offers convenient access to Westminster, Chelsea, and the South Bank with strong connectivity via The Underground, river transport, and major roadways. Iconic landmarks including Battersea Power Station, the U.S. Embassy, and the London Eye are all nearby.

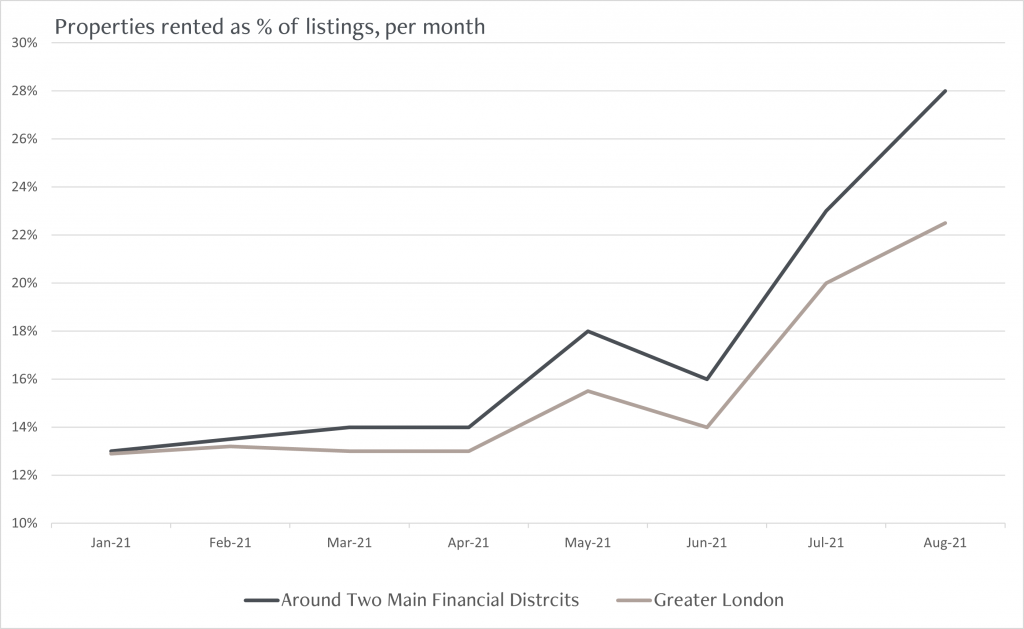

Attendees benefited from in-depth insights into the opportunity and the appeal of living in a highly connected, rapidly developing part of London. The event also highlighted current market trends and the increasing demand for high-quality residential properties in central London. Moreover, Alford Hughes’ London office will facilitate personalized visits to the property for investors travelling to London to help make an informed investment decision.

Reflecting on the success of the event, Mohammed Al Baker, Founder of Alford Hughes, said: “This event reflects our ongoing commitment in bringing exclusive international real estate opportunities to investors in Qatar. We continue to see strong interest in prime global addresses, and London remains a key destination for those seeking long-term value. At Alford Hughes, we are focused on delivering access to international prime real estate opportunities that align with the expectations of discerning investors from Qatar”.

Since launching in 2020, Alford Hughes has introduced a strong portfolio of internationally recognised properties to the Qatari market. With increasing demand for global real estate, the company continues to support local investors in accessing prime opportunities abroad. By simplifying the process from sourcing to acquisition and hassle-free management of international property portfolios, Alford Hughes has built a trusted presence within Qatar’s international property investment space.