The ‘Elizabeth line,’ or ‘Lizzie line,’ as it has already been dubbed, is Europe’s largest building project and London’s largest infrastructure project in 20 years.

The new route will revitalize London transit, making commuting easier and will continue to provide an opportunity for property investors.

40 stations will provide direct links to formerly unconnected routes, reducing travel times and greatly alleviating congestion. The 100-kilometer project will connect London’s Docklands, City, and West End to Heathrow Airport, Berkshire, and Essex, and will include ten new stations.

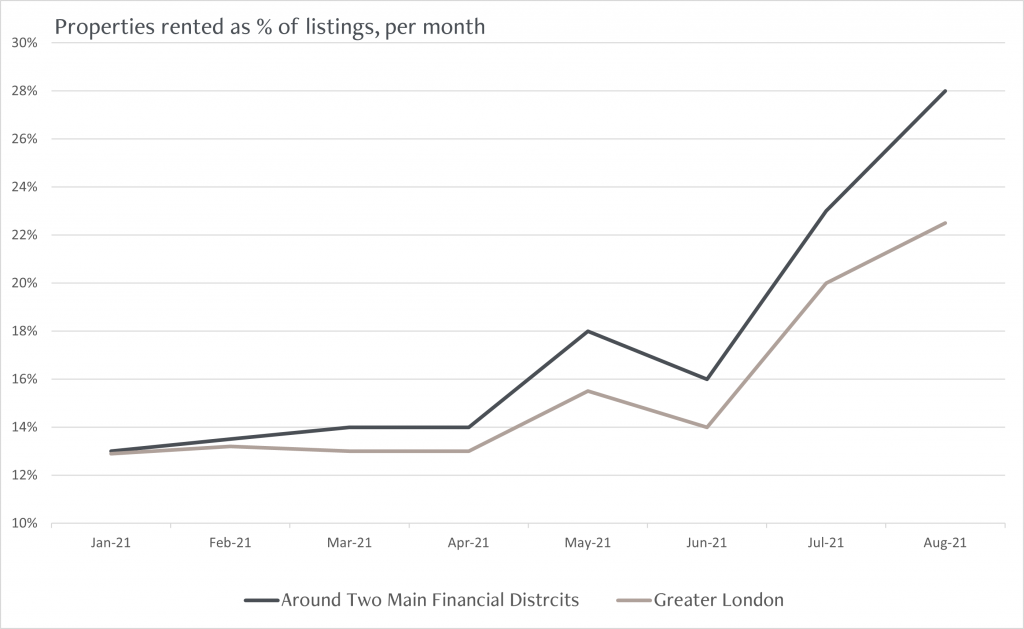

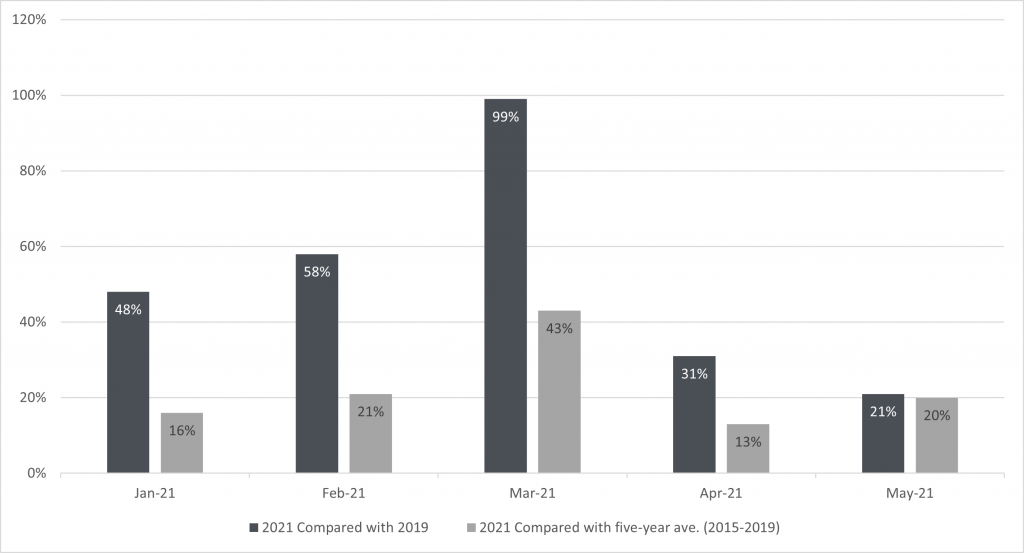

Even though some regions have already seen tremendous growth because of the Elizabeth Line’s announcement, astute investors can still uncover value near the now better-connected stations. Although investors typically have the foresight to invest in future projects, owner occupier buyers and tenants have a more short-term perspective and need to see such projects up and running before committing to buy or rent, which is likely to drive growth in sales and rental prices in these areas in the coming years.

Hanwell in the London Borough of Ealing, which Alford Hughes has identified as being primed to benefit, will see the largest reduction in journey times along the new line, with services from Hanwell Station to Heathrow Airport taking 11 minutes, down from 40 minutes currently, and commuting to Bond Street taking 17 minutes, down from 45 minutes.