Alford Hughes, Qatar’s only international prime real estate office, hosted a VIP launch event of W Residences Manchester for investors in Qatar. The event held at The Corinthia Yacht Club, was hosted by football legend and owner of Relentless Developments, Gary Neville and in attendance were Mohammed Akbar Al Baker & Hussain Akbar Al Baker, Founders of Alford Hughes among other distinguished guests.

W Residences Manchester are the first branded residences in the city of Manchester, one of the fastest growing real estate markets in the world.

Key Highlights of W Residences Manchester:

- A collaboration between Gary Neville’s Relentless Developments, property developer Salboy, and Marriott International.

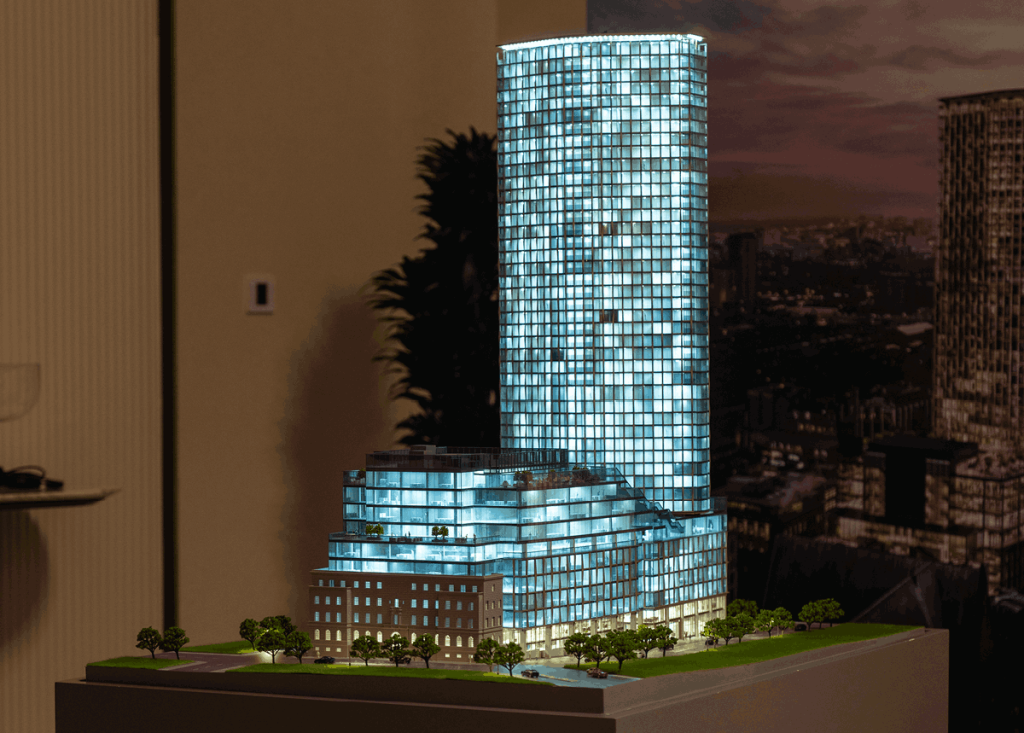

- Situated within the £400 million St Michael’s development in the heart of Manchester, featuring 217 apartments alongside a 5-star W Hotel.

- The luxury residences offer all the amenities and services of a W Hotel.

- The residences, located within the iconic 41-storey tower, are set to open in Q1 2027.

Gary Neville, Director at Relentless Developments, expressed his excitement, stating, ” There is no better home for W Hotel & Residences in the North of England than Manchester. The iconic 41-storey development is going to put No.2 St Michael’s on the global map ”

Simon Ismail, Co-founder & MD, Salboy Group, added, “W Residences Manchester will offer a residential living experience and level of service unlike anything in the city right now.”

Ryan Dougan, Lead Consultant, Investment Advisory at Alford Hughes, added, “We are delighted to introduce the W Residences Manchester to property investors in Qatar, this project offers a unique opportunity as the first branded residence in the UK outside of London and is another example of how Alford Hughes are bringing best in class real estate to our investors in Qatar. We will be showcasing these exclusive apartments for the next two months in the Alford Hughes Lounge on the Pearl and would encourage anyone considering buying an investment property to arrange a private presentation to find out more about this landmark project.”