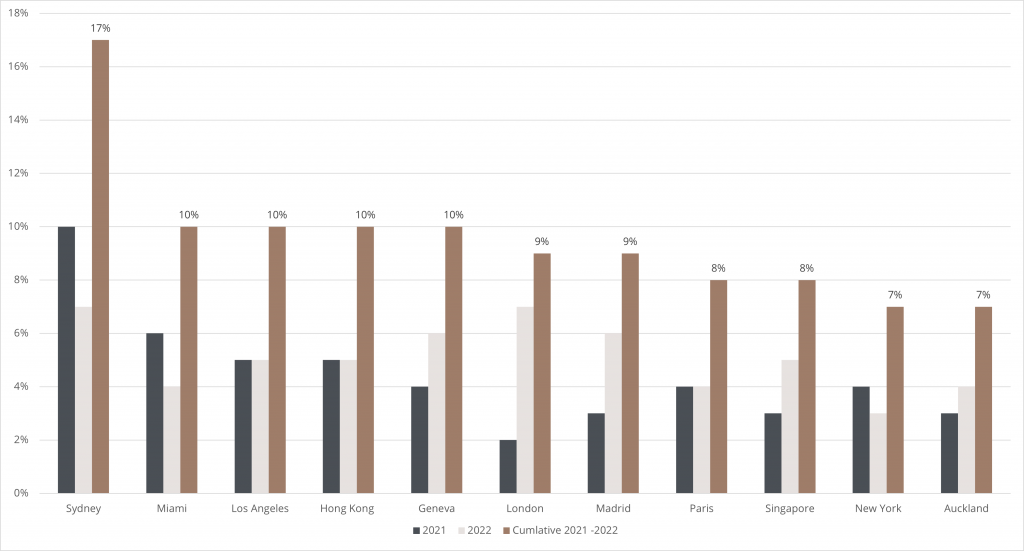

Sydney leads in 2021 with the city expected to see growth of 10%.

Next year, Sydney is also expected to outperform and will share the top spot with London, both cities are expected to see an increase of 7% in 2022.

Miami is predicted to have the second-highest increase this year at 6%, with a further 4% in 2022.

New York should see prices rise by 4% this year, which would be its strongest performance since 2015, followed by a further 3% rise in 2022

What is driving the increase in values?

Government measures have helped protect economies, and cities are now on the rebound.

In addition, the pandemic has inspired many buyers to relocate or expand their holdings. Households accrued a total of over US$5 trillion globally in savings during lockdown, enabling some homeowners to undertake home improvements. Others have opted to relocate, upsize, downsize, or buy a second home/investment property.

The lack of supply in several key cities has been exacerbated as construction rates slowed due to lockdowns and social distancing, putting upward pressure on prices

What lies ahead?

The outlook for prime residential markets will be closely tied to the ease with which cross-border transactions can start to normalise, and whilst virtual viewings and improved technology have assisted in this area, the reality is the resumption of commercial air travel will be key.

Global prime forecast by city