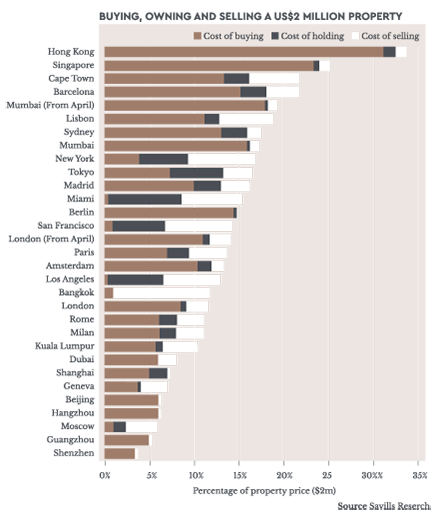

Buying, owning and selling a US$2 million property for non-resident purchasers.

For those looking to purchase a property abroad, the associated costs with buying, owning and selling a property can influence buyer decisions.

Property taxes are also often used as a tool by governments to influence residential markets. Since the pandemic, we have seen tax reductions be used as a tool to drive growth in residential markets such as London and Mumbai.

According to research by Savills in their Prime Index: World Cities 2021 report, Hong Kong is the most expensive in the index. Here, an overseas buyer can expect to pay over 30% of the purchase price – most of which is stamp duty for overseas buyers. On the other hand, Shenzhen has the cheapest associated costs but has the tenth most expensive purchase price.

The research is based on a non-resident overseas buyer purchasing a $2 million property.

This is for use as a second home for less than nine months of the year over a five-year hold.